Transportation Bond 2015

Election Results: The transportation bonds on the May 9, 2015 ballot were approved by Georgetown voters with 75.18 percent of voters in favor.

A bond proposal on the May 9 ballot in Georgetown authorized $105 million to fund transportation projects.

Funding is in three categories: build, design, and plan.

Build: construction of new roads or sidewalks

Design: engineering to make projects shovel-ready when construction funding is available

Plan: initial design work

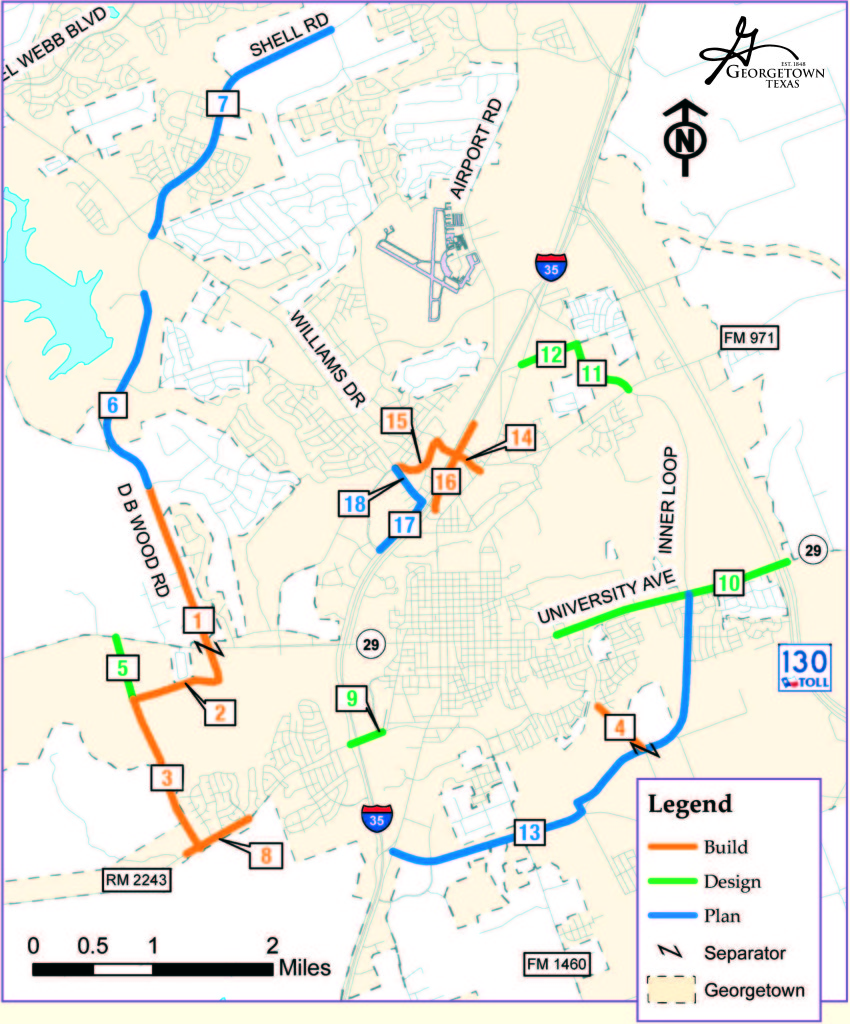

Proposed projects would address five key transportation objectives. Click on the overall transportation projects map or the individual projects below for additional information. Approximate costs and percent completion were current as of April 2021.

Overview

Costs and percent completion were current as of April 2021.

- Estimated cost for road projects: $105.5 million

- Spent to date: $90.7 million

- Remaining allocations: $14.8 million

The 2015 bond included several projects that were earmarked for design only (i.e. no construction funding). Council has chosen to not pursue design-only projects, as plans quickly become outdated, especially with our tremendous growth rate.

The City is proposing repurposing $14.8 million of the remaining allocations from the 2015 bond in conjunction with the proposed 2021 mobility bond projects.

North-South Mobility

1. DB Wood Road (build) University to Oak Ridge

Approx. cost: $18.36 million | Under design (5% complete)

There will be an open house meeting about this project on June 17, 2021 at 6 p.m. The open house meeting at 6 p.m. will be in the training room at the Public Safety Operations and Training Center, 3500 D.B. Wood Road. A short presentation about the project by City staff will be given at 6 p.m., followed by time for questions and answers.

2 & 3. Southwest Bypass (build) Wolf Ranch Parkway to Leander Road and Wolf Ranch Parkway

Cost: $19.3 million | Complete (100% complete)

4. Southwestern Boulevard (build)

Approx. cost: $4.19 million | Under design, construction dollars included in 2015 bond (0% complete)

5. Southwest Bypass (design) Wolf Ranch Parkway to University Avenue

Approx. cost: $512,500 | Under design, Williamson County partnership (25% complete)

East-West mobility

8. Leander Road (build)

Approx. cost: $5.23 million | Under design, construction dollars proposed in 2021 bond (10% complete)

9. Leander Road Bridge (design)

Approx. cost: $4.61 million | TXDOT fully funded, City participation no longer needed. This decision left $4.61 million in voter-approved allocations to be reprioritized, which the City is proposing be repurposed for projects in conjunction with the 2021 mobility bond

10. East University Avenue (design)

Approx. cost: $4.1 million | Not started (0% complete) due to lack of construction funding

11. NE Inner Loop (design)

Approx. cost: $1.03 million | Not started (0% complete) due to lack of construction funding

12. Stadium Drive (design)

Approx. cost: $1.03 million | Not started (0% complete) due to lack of construction funding

13. SE Inner Loop (plan)

Approx. cost: $5.72 million | Under construction, GTEC funding construction (25% complete). The design to fund the $1.2 million for design and fund construction through GTEC left $4.5 million in voter-approved allocations to be reprioritized, which the City is proposing be repurposed for projects in conjunction with the 2021 mobility bond.

Central core mobility

14. Northwest Boulevard Bridge (build)

Approx. cost: $12.4 million | Estimated completion Spring 2021 (90% complete), currently savings of $1.15M from low bids

15. Rivery Boulevard extension (build)

Cost: $6.65M | Complete (100% complete)

16. I-35 northbound frontage (build)

Approx. cost: $7.02 million | Now fully funded by TXDOT, City participation no longer needed. This decision left $6.87 million in voter-approved allocations to be reprioritized, which the City is proposing be repurposed for projects in conjunction with the 2021 mobility bond.

Preliminary engineering projects

Approx. $5.7 million was set aside from the 2015 road bond to help pay the design and preliminary engineering costs for multiple projects. The City plans to move forward on these projects once the City has located funding for construction.

6. DB Wood Road (plan) Oak Ridge to Overlook Drive

The proposed 2021 mobility bond includes 2015 bond allocations for design and new funding for construction costs.

7. Shell Road (plan)

The proposed 2021 mobility bond includes 2015 bond allocations for design and new funding for construction costs.

17. I-35 southbound frontage (plan)

Now fully funded by TXDOT as part of Williams Drive and I-35 diverging diamond intersection project. City participation no longer needed.

18. Williams Drive (plan)

The proposed 2021 mobility bond includes 2015 bond allocations for design and new funding for construction costs.

Sidewalk and ADA accessibility

$10 million (build) | Ongoing, $1 million annually (50% complete)

Intersection and safety improvements

$5 million (build) | Ongoing (60% complete)

Completion of engineering and design work enables a project to be eligible for funding from other local, state, or federal sources when they are available.

Note that anticipated transportation projects may be adjusted as a result of market conditions, available state or federal funding, or other factors.

Contract with voters

A Contract with the Voters as part of the 2015 Transportation Bond Election provides guidelines for the maximum property tax impact as a result of bond debt for a given year and over the term of all bond issuances. The City will manage debt issuances to stay within these per year and overall maximums.

Property tax rate increase from bonds

- Maximum 2 cents per year

- Maximum 10 cents cumulatively

First-year tax impact for average homeowner: $31*

Cumulative impact for average homeowner: $252*

*Average home value: $210,000. Tax impact analysis subject to change based on future values, market conditions, and other factors.