Mobility Georgetown Bond 2021

Election results: The transportation bonds on the May 1, 2021 ballot were approved by Georgetown voters with 66.99 percent of voters in favor.

The bond proposition on the May 1 election authorized $90 million for various street and transportation infrastructure projects.

This page contains more information about the proposition, the impact to tax rates, the projects, and the process the City took to get here. Click the + mark next to the different sections for more information on the topic. Para leer esta página en español, seleccione español en la parte superior de esta página.

Project information sheets and interactive map

View Interactive Bonds MapClick here to download in English | Click here to download in Spanish

Virtual Town Hall about mobility bond

Watch the recording of the April 14, 2021, town hall here. The event featured presentations and Q&A from Georgetown City Manager David Morgan and staff.

This presentation was for information purposes only. The City cannot advocate for or against the bond.

View the presentation slides: English | Spanish

The City of Georgetown has called a bond election for Saturday, May 1, 2021. Voters will consider one bond proposition that includes various roadway and transportation infrastructure projects. This election is being held in conjunction with the May General Election for local offices and propositions for other taxing entities.

The total amount of the bond proposition is $90 million in new spending authorizations. If voters approve Proposition A, the City anticipates raising the property tax rate by 3 cents once the bonds are issued to cover the full cost of the projects. The average Georgetown resident could expect their annual property taxes to increase by $83.40, based on the average homestead taxable value in 2020 of $278,001. The City expects to start work on the projects within seven years, economic conditions permitting.

The anticipated 3-cent tax rate increase would pay for $120 million of bonds, which is the total amount of bonds required to complete the projects. The additional $30 million would come from bonds approved by voters in 2008 and 2015 that were never issued. Click the projects and “Financial information” below for more detail.

This webpage is designed to provide more information about the City of Georgetown Bond Election. It does not advocate passage or defeat of the measure and is intended only for informational purposes. It does not discuss any of the other matters that are to be voted on at the May 1, 2021, election.

The City of Georgetown is committed to compliance with the Americans with Disabilities Act (ADA). Reasonable accommodations and equal access to communications will be provided upon request by calling 512-930-3652.

Proposition Total: $90 million

The Georgetown mobility bond includes 10 roadway projects that together would cost an estimated $120 million. Projects with asterisks include authorizations from the 2008 and 2015 bonds that were never issued.

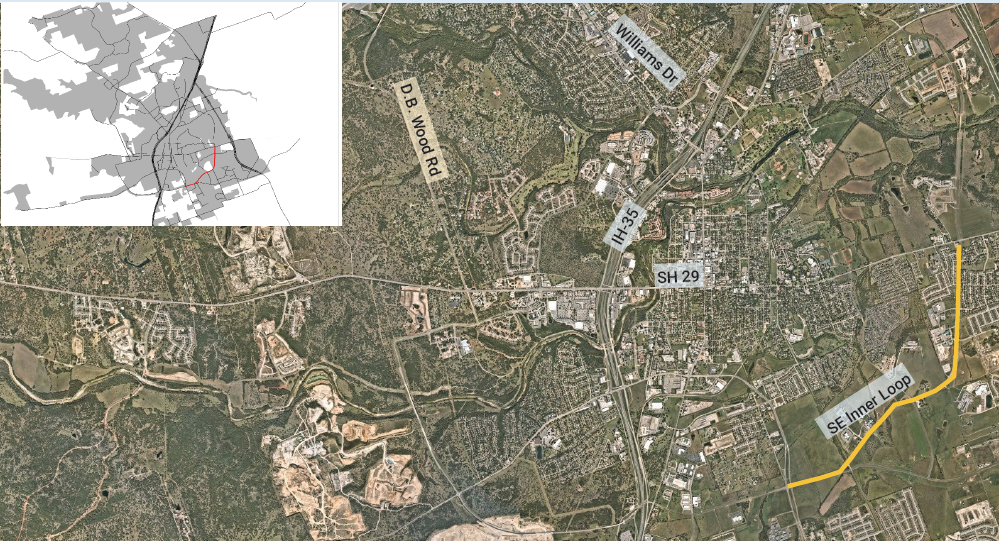

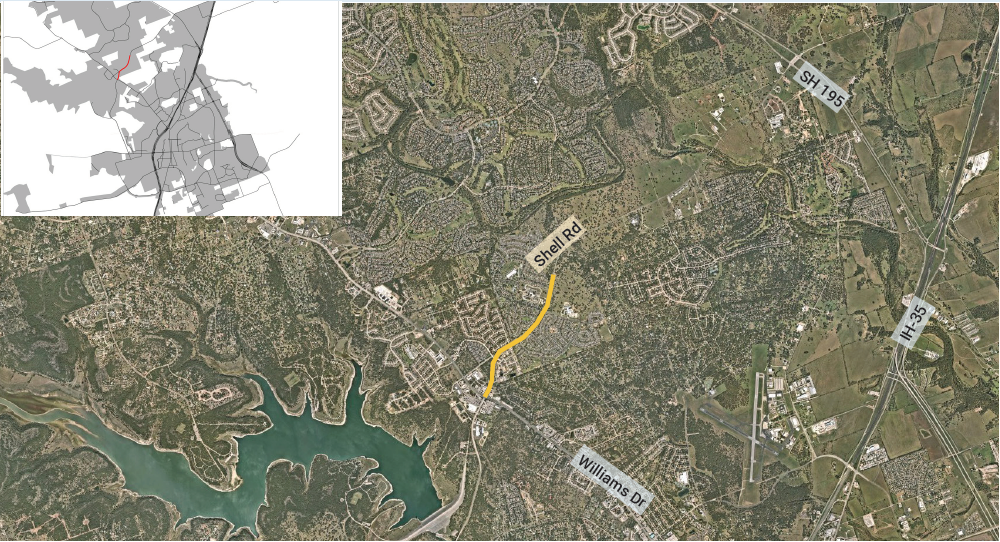

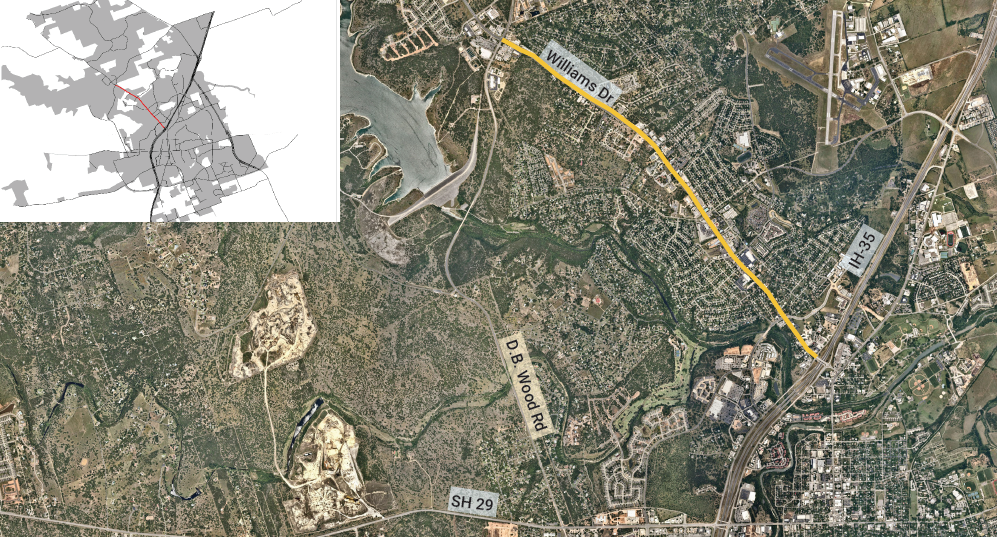

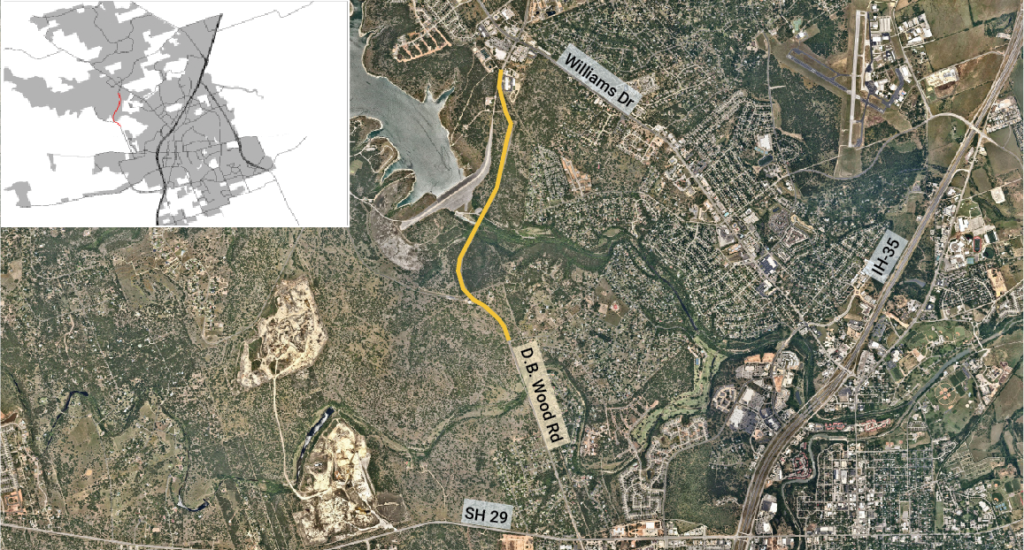

Specifically, the proposition calls for “constructing, improving, extending, expanding, upgrading and/or developing transportation projects for streets, roads, bridges, and intersections, including SE Inner Loop, Shell Road, Williams Drive, DB Wood Road, Leander Road, Austin Avenue, Rockride Lane, and Westinghouse Road, and also including related utility relocation, sidewalks, traffic safety and operational improvements, the purchase of any necessary rights-of-way, design costs, drainage and other related costs.”

All told, the City estimates the Proposition A projects will cost $120 million, which would be funded by an anticipated 3-cent tax rate increase. Of that total, $30 million would come from spending authority granted by voters in the 2008 and 2015 bonds. The City never raised taxes to fully fund those projects. The $90 million in Proposition A would grant the City additional spending authority to increase the scope and finish the 2008 and 2015 bond projects, as well as fund additional mobility projects identified through the selection process. Click the projects and “Financial information” below for more detail.

| Project | Anticipated Amount |

| SE Inner Loop* | $32 million |

| Shell Road* | $12.5 million |

| Williams Drive* | $10.2 million |

| DB Wood Road* | $18.9 million |

| Leander Road* | $7.7 million |

| Austin Avenue | $10.2 million |

| Rockride Lane | $5.8 million |

| Westinghouse Road | $8.2 million |

| Sam Houston Ave. | $4 million |

| Sidewalks, bike lanes, and intersections | $10.45 million |

| TOTAL | $120 million |

The following language is what Georgetown voters will see on their ballots for the May 2021 election:

CITY OF GEORGETOWN, TEXAS SPECIAL ELECTION

CITY OF GEORGETOWN, TEXAS PROPOSITION A

The issuance of $90,000,000 bonds by the CITY OF GEORGETOWN, Texas, FOR TRANSPORTATION PROJECTS FOR STREETS, ROADS, BRIDGES, AND INTERSECTIONS, INCLUDING SE INNER LOOP, SHELL ROAD, WILLIAMS DRIVE, DB WOOD ROAD, LEANDER ROAD, AUSTIN AVENUE, ROCKRIDE LANE, AND WESTINGHOUSE ROAD. Taxes sufficient to pay the principal of and interest on the bonds will be imposed.

FOR ______

AGAINST ______

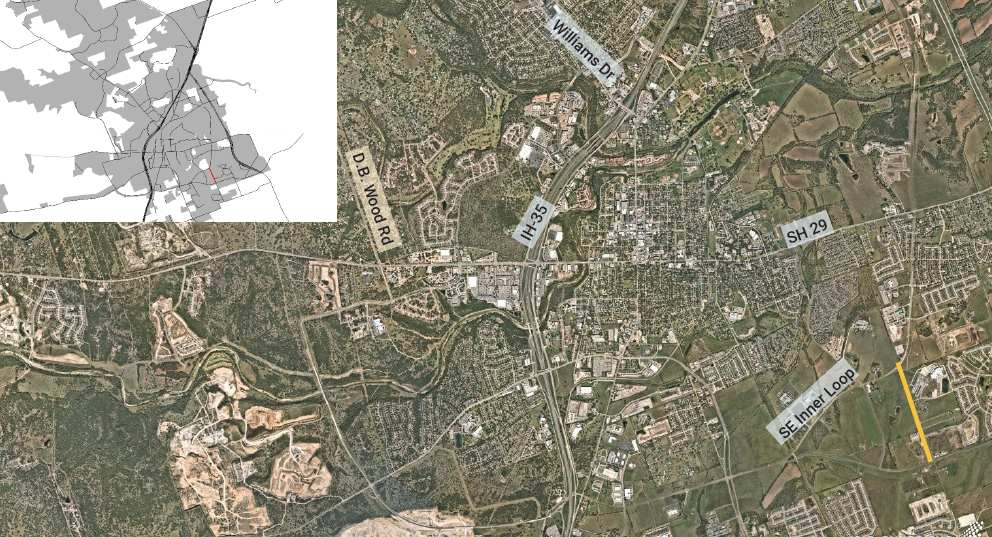

Anticipated total: $32 million

This 2.91-mile project consists of widening SE Inner Loop to a four-lane, divided, minor arterial from SH 29 to Sam Houston Avenue and to a five-lane, undivided, major arterial from Sam Houston Avenue to FM 1460. The project also includes a shared-use path for pedestrians and bicycles on one side.

The City would use the tax increase to finish the following, related 2015 bond project:

SE INNER LOOP: This section is a portion of the Southwest Bypass around the southside of Georgetown and connects I-35 with Sam Houston Avenue. This 2015 bond project will provide construction-ready plans for Phase 1 of the widening of SE Inner Loop from a 2-lane undivided roadway to a 4-lane divided facility.

Anticipated total: $12.5 million

This 1.12-mile project consists of widening Shell Road to a four-lane, divided, major arterial from 500 feet north of Williams Drive to 300 feet north of Sycamore Street, with open-ditch drainage. The project also includes a shared-use path for pedestrians and bicycles on one side.

The City would use the tax increase to finish the following, related 2015 bond project:

SHELL ROAD: The area north of Williams Drive is developing and traffic is increasing along this corridor. This project will provide construction-ready plans widening Shell Road from a 2-lane undivided roadway to a 4-lane divided facility.

Anticipated total: $10.2 million

This 3.18-mile project consists of replacing the existing center turn lane on Williams Drive with a landscaped median, with median openings and left turn bays at strategic locations, to create a four-lane divided roadway from DB Wood Road to IH 35. Precise locations of the median openings will be determined by a forthcoming Williams Drive accessibility/mobility study. In addition, the project will fill existing sidewalk gaps and address ADA accessibility issues.

The City would use the tax increase to finish the following, related 2015 bond project:

WILLIAMS DRIVE: The Williams Drive/Austin Avenue area has been identified as the northern gateway into downtown Georgetown. The project will provide construction-ready plans to add an eastbound right turn lane along Williams Drive between Rivery Boulevard and the I-35 southbound Frontage Road.

Anticipated total: $18.9 million

This 1.99-mile project consists of widening the existing two-lane section of D.B. Wood Road to a four-lane, major arterial with open ditch drainage and a shared-use path for pedestrians and bicycles on one side. This project also includes installing a median in the existing center turn lane south of the Public Safety Center.

The City would use the tax increase to finish the following, related 2008 and 2015 bond projects:

D.B. WOOD ROAD WIDENING: This 2008 bond project would provide funds to add traffic lanes to D.B. Wood Road, also known as Northwest Inner Loop.

D.B. WOOD ROAD OAK RIDGE TO OVERLOOK DRIVE: This 2015 bond project will provide construction-ready plans to widen D.B. Wood Road from a 2-lane to a 4-lane facility from Oak Ridge Drive to Lake Overlook Drive.

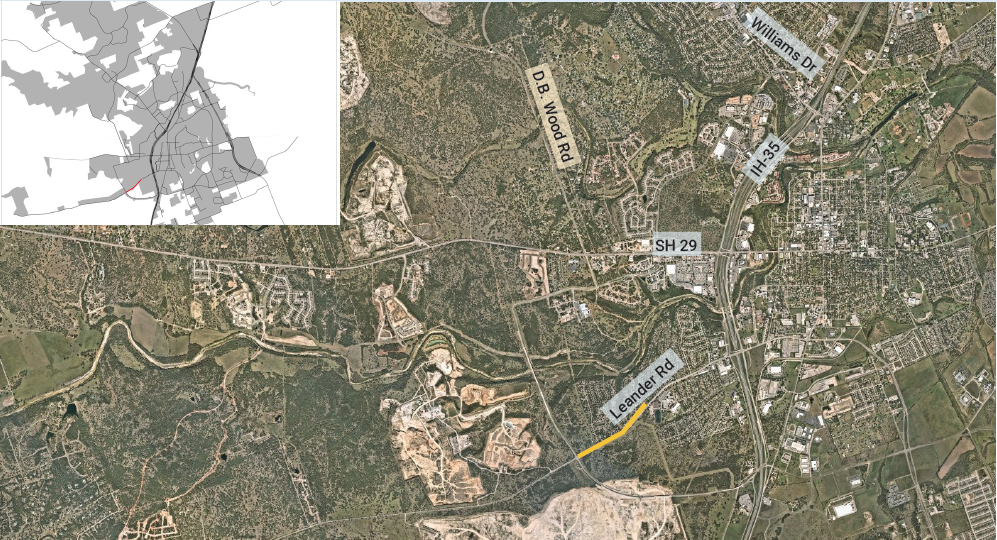

Anticipated total: $7.7 million

This 0.69-mile project consists of widening Leander Road to a four-lane, divided, major arterial from S.W. Bypass to Norwood Drive with open ditch drainage. This project will also include a grass median and sidewalks on both sides of the road.

The City would use the tax increase to finish the following, related 2015 bond project:

LEANDER ROAD (RM 2243): This 2015 bond project will provide design and construction to widen Leander Road (RM 2243) from a two-lane to a four-lane facility from 400 feet West of Southwest Bypass to River Ridge Drive. About 30 percent of the plan for this project is already completed.

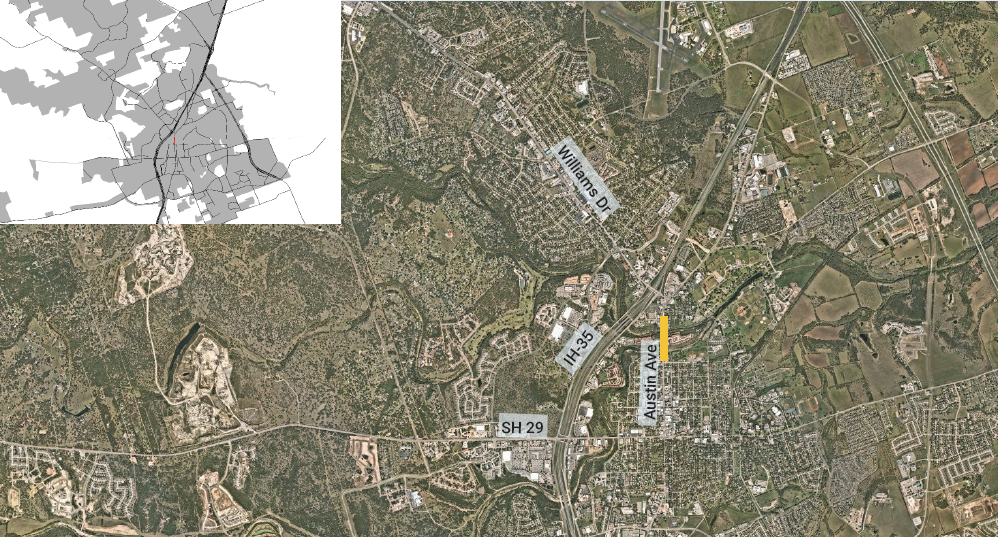

Anticipated total: $10.2 million

This proposition would provide funding to rehabilitate the bridges on Austin Avenue and construct a new pedestrian and bicycle bridge over the north and south forks of the San Gabriel River. The new pedestrian and bicycle bridge would cost $3.8 million of the total estimated cost to construct.

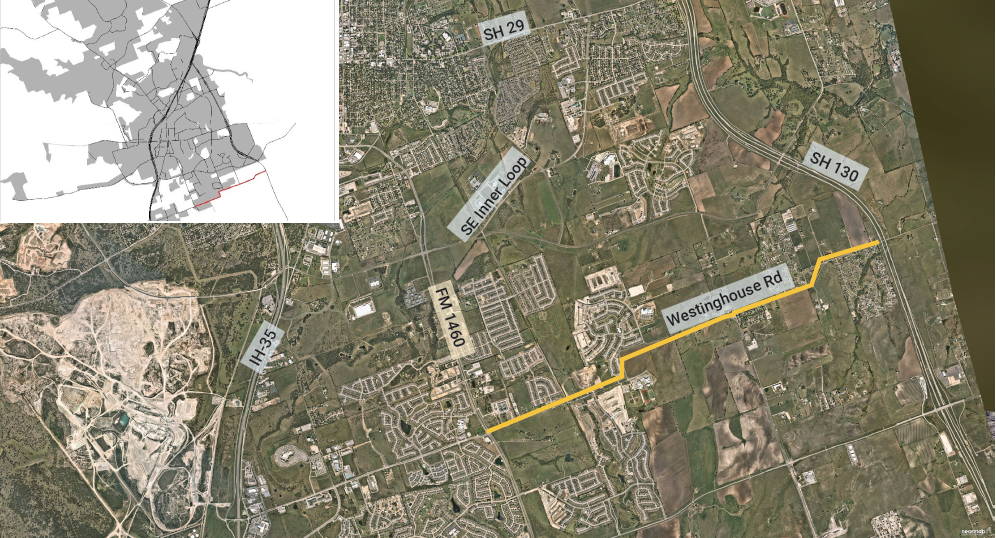

Anticipated total: $8.2 million

This project is a partnership between the City of Georgetown and Williamson County that would fully reconstruct the two-lane section of Westinghouse Road from FM 1460 to SH 130. This project includes improving shoulders and removing 90-degree turns. Voters approved this project in the 2019 Williamson County bond. The total project cost is $20.2 million. The City would contribute $8.2 million, primarily to improve shoulders on the two-lane section of the road. This cost roughly corresponds to the portion of the extension in the City limits, relative to the full project length.

Anticipated total: $4 million

This 2008 bond project would provide the City’s portion of funding to extend Sam Houston Avenue (initially designated Southeast Arterial 1) as a two-lane road from Patriot Way to SH 29.

Voters approved this $22.5 million project in the 2019 Williamson County bond. The City’s $4 million contribution roughly corresponds to the portion of the extension in the City limits, relative to the full project length. Other funding sources for SE1 include Williamson County and the City’s 0.5 percent 4B sales tax associated with the Georgetown Transportation Enhancement Corporation (GTEC).

Anticipated total: $10.45 million

The City of Georgetown 2021 Mobility Bond aims to increase roadway capacities and create new connections within and among communities. In addition to the proposed roadway projects, a portion of bond dollars will be allocated to additional infrastructure projects including bicycle facilities, sidewalks, intersection improvements, and transportation technology upgrades. Funding would go toward priority projects identified in both the Sidewalks and Bicycle master plans, as well as prioritized intersections and corridors. Authorization from the 2015 bond could be used for sidewalk and intersection work.

The $90 million ($90,000,000) in project expenditures authorized by City of Georgetown Proposition A would be funded by general obligation bonds, which are repaid by property taxes. If approved, the City expects to issue bonds in installments beginning in 2021.

If the proposition passes, the City anticipates raising the property tax rate by 3 cents per $100 of valuation once the bonds are issued. This estimate assumes annual growth of the City’s taxable assessed valuation at a rate of 7 percent through tax year 2046. The tax increase would go into effect on the next year’s tax bill. Interest on the proposed bonds under Proposition A has been estimated at a weighted average interest rate of 3.33 percent.

Homeowners who are 65-or-older or disabled whose City taxes are frozen when the bonds are issued will not have their property taxes increased if the bonds are approved, under current City taxing procedures.

Anticipated tax bill impact when tax rate is fully implemented from passage of the bond proposition:

| Taxable Property Value (amount includes all exemptions) | Anticipated Annual Tax Bill Impact |

| $100,000 | $30 |

| $200,000 | $60 |

| $300,000 | $90 |

| $400,000 | $120 |

| $500,000 | $150 |

| $600,000 | $180 |

| $700,000 | $210 |

The anticipated 3-cent tax rate increase would pay for $120 million of bonds, which is the total amount of bonds required to complete the projects. The additional $30 million would come from bonds approved by voters in 2008 and 2015 that were never issued. About 2 cents of that increase would pay for the projects in the 2021 bond. The other 1 cent would go toward related projects voters approved in both the 2008 and 2015 bonds.

| Funding authorization | Amount | Portion of anticipated tax rate increase |

| 2021 Bond | $90 million | 2 cents |

| 2015 Bond | $14.8 million | 0.493 cents |

| 2008 Bond | $15.2 million | 0.507 cents |

| TOTAL | $120 million | 3 cents |

More resources:

The total amount of the May 2021 bond proposition is $90 million in new spending authorizations. If voters approve Proposition A, the City anticipates raising the property tax rate by 3 cents once the bonds are issued to cover the full cost of the projects. The anticipated tax rate-increase would pay for $120 million of bonds, which is the total amount of bonds required to complete the projects. The additional $30 million would come from bonds approved by voters in 2008 and 2015 that were never issued.

Why are there $30 million left in allocations from the previous bonds?

A few reasons, but we want to state now that the City doesn’t have the $30 million of bond proceeds from this allocation. Those bonds were never sold, and the taxes have never been raised to finish those projects, for a variety of reasons detailed below, and so would need to be raised now to complete the projects.

One reason taxes haven’t been raised to fund remaining projects is due to the economic downtown in 2008. City Councils over the next decade did not increase taxes to complete all the projects in order to relieve pressure on the property tax rate. That meant some projects from the 2008 and 2015 approved bond program have not yet been started or are only partially complete. Since the taxes were not raised initially, they would need to be raised now to complete these projects, as well as to pay for some expansion of these projects to account for growth.

Additionally, some projects are completed with partnerships with other agencies, such as Williamson County, Texas Department of Transportation, and others. These other agencies sometimes change their timeline or funding plans, which then affects the City’s ability to complete the project. In the cases of two projects from 2015, I-35 northbound Frontage Road and the Leander Road bridge, TXDOT will take over funding and completion. This means the City can repurpose the authorization for those projects to other authorized projects under the applicable bond authorization.

Finally, some prior bond authorizations covered only the design of the project, not construction. Completing design, then setting it on the shelf until construction can be funded, often years later, is not a useful strategy during our rapid growth. Therefore, some of the design-only projects were not started while we attempt to identify construction funding. In the 2021 bond, we are trying to complete projects, or complete sections of projects, to avoid that circumstance.

The following table shows which projects were completed from the prior bond programs. It also shows which projects were affected by changes in partnership funding, and which projects were design only. The table highlights the authorization from prior transportation bonds that is available to reprioritize for current transportation project use.

All told, four of the six road projects from the 2008 bond and five of 20 projects from the 2015 bond are substantially to totally complete or are following annual allocations. The remaining 17 projects fall into at least one of the categories above. The City would raise the property tax rate to generate the funds necessary to complete those projects.

The City of Georgetown can legally use the proceeds of authorized but unissued transportation bonds from the 2008 and 2015 bond elections for the identified and proposed 2021 mobility bond. As part of the process of determining the size of the 2021 mobility bond, the City identified certain projects and components of projects that would be covered by the purpose language of the 2008 and 2015 transportation bond propositions. Also, the amounts of those projects won’t exceed the amount of authorized but unissued bonds still remaining from those previous propositions. For additional detail, please see this letter from the City’s bond counsel.

In February 2020, City Council directed staff to initiate a schedule and overview for a proposed transportation bond program for the November 2020 election to proactively manage expected growth. Due to election and public engagement limitations of COVID-19, the election was pushed back to May 2021.

The purpose of the bond is to advance Georgetown’s connectivity and safety by upgrading streets, bridges, and sidewalks delivering projects consistent with community expectations to manage accelerated growth by:

- Increasing the capacity of roadway network and bridges with high traffic volume.

- Improving intersections and building sidewalks throughout Georgetown to create new connections within and among neighborhoods.

- Coordinating with other planned transportation work to accelerate delivery to Georgetown residents.

In July 2020, City Council created a 16-member Citizen Advisory Committee to review and vet criteria for projects, prioritize and rank staff proposals, and make a final recommendation to Council for what to include in the bond. See a list of the committee members in our FAQ below.

The advisory committee spent six months reviewing and evaluating 23 possible bond projects with an estimated total cost of more than $400 million. In January 2021, the Citizen Advisory Committee provided Council with rankings of the top 10 roadway projects and allocations for sidewalks, bicycle facilities, intersections, and transportation technology. The committee’s recommendations were informed by two rounds of public engagement. View the engagement reports in the timeline below.

In February 2021, the Georgetown City Council passed a resolution calling for a $90 million bond election on May 1, 2021, and set ballot language for the bond proposition. View the resolution and ballot language in English and Spanish languages here.

- Public Engagement Phase I: July 15 – Aug. 15, 2020 (View the Engagement Report)

- Mobility Georgetown 2021 Citizen Advisory Committee Meetings: August 2020 through Jan. 4, 2021

- Public Engagement Phase II: Nov. 16 – Dec. 7, 2020 (View Engagement Report and Nov. 16 Virtual Town Hall)

- Mobility Georgetown 2021 Citizen Advisory Committee reviewed public input: Dec. 14, 2020

- Final Mobility Georgetown 2021 Citizen Advisory Committee Recommendations: Jan. 4, 2021

- Mobility Georgetown 2021 Citizen Advisory Committee recommendations presented to Council: Jan. 12, 2021

- Council adopted final project list: Feb. 9, 2021

- Council called bond election: Feb. 9, 2021

- Election Day: May 1, 2021

Citizens must be registered to vote in the City of Georgetown (Williamson County) in order to be eligible to vote in the May 1, 2021, bond election.

Important Election Dates:

- April 1 – Last day to register to vote

- April 19 – First day of in-person early voting

- April 20 – Last day to apply for a ballot by mail

- April 27 – Last day of in-person early voting

- May 1 – Election Day

In order to cast a ballot in the bond election, you must be both registered to vote in and be a resident of the city limits of the City of Georgetown. If you’re unsure of whether you are eligible to vote, or would like to learn more, visit votetexas.gov.

You are eligible to register to vote if:

- You are a United States citizen;

- You are a resident of the county in which application for registration is made;

- You are at least 17 years and 10 months old (your registration will be effective 30 days after you submit your voter registration application or on your 18th birthday, whichever is later. In order to be eligible to vote, you must turn 18 on or before election day);

- You are not a convicted felon, or, if convicted you have been pardoned or fully discharged your sentence, including any term of incarceration, parole, supervision, or probation; and

- You have not been declared by a court to be either totally mentally incapacitated or partially mentally incapacitated without the right to vote.

Williamson County residents can download voter registration forms online at: www.wilco.org/departments/elections

Registered voters in Georgetown participating in the May 1, 2021, election may vote at any of the locations for the election listed on Williamson County Elections page.

What is a general obligation bond?

Periodically, the City of Georgetown authorizes general obligation (GO) bonds to restore, replace, and expand infrastructure and capital assets across the city. GO Bonds are a debt obligation issued by local governments to fund public purpose capital improvements, such as roads and public facilities. GO bonds are secured by and payable from the City’s pledge of ad valorem tax levied on all taxable property within the City. GO Bonds are proposed and voted on in citywide elections.

How much will the Mobility Georgetown 2021 bond be for?

The total amount of the bond is for $90 million in new spending authorizations.

Why hasn’t the City finished the 2008 and 2015 bond projects yet, and how do they fit in with the 2021 bond?

In approving the previous bonds, voters authorized the City to increase its debt to fund all the projects. However, projects were spaced out in such a way that increased sales and property tax revenues provided the City with enough money to cover 2008 and 2015 bond project debt without raising taxes. Additionally, several 2008 and 2015 bond projects have not moved forward due to a variety of factors, including a lack of construction funding and other agencies altering their funding levels.

As the City worked through potential projects for the 2021 project, it was clear remaining projects from the 2008 and 2015 bonds could be expanded to accommodate growth. Proposition A would grant the City $90 million in additional spending authorization to provide construction funding to expand and finish some of the remaining 2008 and 2015 projects, as well as fund additional mobility projects identified through the process. The anticipated 3-cent increase to the property tax rate is expected to raise $120 million, including the additional $30 million previously unspent from the 2008 and 2015 bond programs, through the seven-year bond program to cover all the projects.

If Proposition A does not pass, City Council would reassess how if and how to fund finishing the projects from previous bonds.

If the Mobility Georgetown 2021 bond passes, will it increase the property taxes paid by homeowners who are 65-or-older or disabled?

Homeowners who are 65-or-older or disabled whose City taxes are frozen when the bonds are issued will not have their property taxes increased.

What if I have a question or comment about the Mobility Georgetown 2021 bond?

Questions and comments about Mobility Georgetown 2021 bond can be directed to pio@georgetown.org.

When would the first bond projects be under construction?

If the bond passes in May 2021, the City will develop a schedule for when it will bid the projects. The first bonds would be issued in late summer 2021 to allow the projects to start in October 2021.

When would all the projects from this bond be finished?

The City wants to address the highest mobility needs, in the shortest amount of time, with as small of impact to property taxes as possible. Therefore, the City is contemplating a seven-year bond issuance schedule. If that is the result, we would intend to begin all projects by FY2028. If the 2021 Road Bond passes, it is expected that Council will conduct a workshop to discuss scheduling the proposed projects.

Why does the Williams Drive project eliminate the open turn lane? Won’t that increase traffic congestion?

Traffic studies have shown, and most traffic engineers agree, that limited access decreases congestion on the main road. Imagine if businesses were allowed direct access to I-35. Movement would slow down, fewer cars could get through, and congestion would increase. While Williams Drive is certainly not the same kind of road as I-35, the principle is the same.

Allowing unrestricted driveway access to a major roadway increases conflicts between turning and through traffic, resulting in traffic having to slow down to accommodate multiple movements, allowing fewer cars to get through on Williams Drive, and increasing congestion. The center median with strategic left turn lanes would focus traffic at certain points, increase the likelihood of a traffic signal to provide safer turning movements, and allow more free flow of traffic at other locations along Williams.

Also, the center median with strategic left turn lanes is a recommendation of a recently completely comprehensive look at the Williams Drive Corridor. Before any median is constructed, a detailed traffic study and extensive public outreach will be conducted to determine if and where the proposed medians will serve Georgetown best.

It’s also important to point out that the estimated 2021 mobility bond costs for Williams Drive is not exclusively for medians. Funds would also be used for designated left turn lanes, right turn lanes, intersection enhancements, pedestrian improvements, and potentially additional traffic signals.

The proposed projects seem more concentrated in south Georgetown. Why is that?

The Development Pipeline Map and growth heat map show tremendous growth throughout our entire service area, as well as the intensity of new development. The fastest-growing part of Georgetown is the southeast portion of the City.

The gray area in the development pipeline map represents the city limits, so much of the growth to the north is outside our city limits and is being supported by Williamson County. However, the Shell Road, DB Wood, and Williams Drive projects – totaling an estimated $41.7 million of the proposed bond program – affect the northwest part of the City.

Will the Mobility Georgetown 2021 bond increase taxes?

If voters approve the proposition, the City anticipates raising the property tax rate by 3 cents once the bonds are issued. The average Georgetown resident could expect their annual property taxes to increase by $83.40, based on the average homestead taxable value in 2020 of $278,001. Additional factors include future property values in the City over the life of the bonds and bond market interest rates at the time the bonds are issued. This estimate is based on an annual growth of 7 percent in assessed valuations. The tax increase would go into effect on the next year’s tax bill. Interest on the proposed bond under Proposition A has been estimated at a weighted average interest rate of 3.33 percent.

The anticipated 3-cent increase to the property tax rate is expected to raise $120 million through the seven-year bond program. About 2 cents of that increase would pay for the projects in the 2021 bond. The other 1 cent would go toward completing work on related projects voters approved in both the 2008 and 2015 bonds, but that were never funded.

The Council appointed a 16-member Citizen Road Bond Committee that struggled mightily with where to best allocate road bond dollars and recommended projects they felt were most critical to relieve traffic congestion in Georgetown as well as plan for the future. If the proposition is approved, the project costs would be paid by property tax dollars through property tax rates. The estimated 3 cent increase to the property tax rate is the estimated impact of the bond program. The City works to balance property tax rates with needs for other services, such as police, fire, transportation, and more. Currently, the City of Georgetown has the lowest property tax rate of any city over 20,000 in population in Central Texas.

Traffic on SH 29 and I-35 is horrible. Why don’t any of the mobility bond projects address this?

The anticipated increased traffic on Hwy 29/University Avenue through that intersection from new development in Georgetown is being addressed in two key ways.

Two proposed projects will create a complete bypass to Hwy 29/University Avenue and alleviate through traffic on that road. These include the Sam Houston Ave extension east of SH 130 – one of the mobility bond 2021 projects highlighted on this page – and the connection of the Southwest Bypass directly to Hwy 29 east of DB Wood — a Williamson County bond project. Construction is anticipated to begin this fall on the Southwest Bypass extension project.

Also, TXDOT is funding a project to redesign and rebuild the Hwy 29 and I-35 intersection. The project is in design and is anticipated to begin construction in 2025 with completion in 2027. Find more on the TXDOT My35.org site, including schematics, timelines, and more, at http://www.my35.org/capital-project-sh29.htm

How has the public been involved in developing this bond?

Residents drove the development of this bond, from a citizen advisory committee that provided final recommendations to multiple opportunities for public feedback before the election was called. The public first helped identify transportation priorities, to help the committee narrow down its list of projects. Most responders said they want bond projects to focus on investing in roads and intersections, managing congestion, and improving traffic signals. Read the full engagement report here.

In fall 2020, the public provided input on a list of 10 proposed projects. The committee reviewed this feedback and use it to develop its recommendations to City Council. Read the full engagement report here.

Due to public health and safety concerns with the COVID-19 pandemic, opportunities to provide feedback were more limited than previously anticipated. The City made every effort to reach as many Georgetown residents as possible, including a dedicated website, printed surveys at public facilities, digital surveys in English and Spanish, and virtual meetings of the citizen committee and City Council.

How were the projects selected?

The Georgetown City Council selected 16 community members to serve on a citizens committee to help evaluate each eligible project and ultimately make a recommendation to the Council on a package of investments. The committee recommendations were presented to Council in January 2021.

The committee used public input about priorities and projects to develop its recommendations.

Who was a part of the citizen committee?

Georgetown Mayor and City Council members each appointed two community members to the citizen committee. The members were as follows:

| Council District | Name |

| Mayor | Ercel Brashear |

| Mayor | Chere Heintzmann |

| District 1 | Alison McKee |

| District 1 | Bob Smith |

| District 2 | Keith Brainard |

| District 2 | Bill Dryden |

| District 3 | Rich Barbee |

| District 3 | Walter Bradley |

| District 4 | Kathy Sutphin |

| District 4 | Steve Ricks |

| District 5 | Steve Bohnenkamp |

| District 5 | Kimberly Bronner |

| District 6 | Glenn Holzer |

| District 6 | Jesse Saunders |

| District 7 | Regina Watson |

| District 7 | Chris Leon |

The Mobility Georgetown 2021 Citizen Advisory Committee met from 5:30 to 7 p.m. on the second and fourth Mondays of each month, from Aug. 24, 2020, through Dec. 14, 2020. The committee also met Jan. 4, 2021, to finalize its recommendations to Council. The committee did not have set meetings in November to allow for public engagement opportunities. Due to COVID-19 restrictions, all meetings were held over Zoom. Agendas and minutes are available at agendas.georgetown.org.

What were the criteria being used to select final projects?

The citizen committee considered project information and focused on project readiness, bond funding eligibility (e.g., serves a government purpose and has a 20-year useful life), cost considerations, and critical system needs. Each committee member also was asked to identify criteria that helped further evaluate each project.

How does a bond work?

A general obligation bond (GO bond) is a common financial tool used by governments that is secured by and payable from a pledge of ad valorem tax levied on all taxable property within the City to repay bondholders over the life of the bonds.

Generally, banks or bond underwriters provide a governmental entity funds up front for capital projects to allow for the construction of large capital projects the entity wouldn’t otherwise be able to afford. The governmental entity then repays those funds, including interest, over time.

In Georgetown, GO bonds are typically sold in a competitive sale to ensure the lowest interest rate, but will use other methods of sale if the market calls for it. Interest on the bonds is tax exempt to the bondholders, because the City of Georgetown is a government entity and the projects are public projects. The City continues to pay off older GO Mobility Bond debt, which as of Spring 2021 was $84,640,934.45, including principal and interest.

How does the City currently pay for roadway projects?

The City currently funds roadway projects several ways, including through our general fund, sales taxes, bonds, development impact fees, and cost sharing with federal and state funding.

What is Georgetown’s current general obligation bond initiative?

Georgetown’s most recent GO Bond authorization was presented to voters in May 2015, when voters approved the $105 million transportation bond.

Prior to the 2015 transportation bond, the City’s last GO Bond initiative was the 2011 Public Safety Facility Bond, which authorized an issuance of $29.5 million to fund the new Public Safety Operations and Training Facility.

What factors can affect the estimated cost of the bond and tax increase?

Bonds for the mobility projects would likely be issued in multiple phases to match funding with cash flow needs as the projects progress. The tax rate is based on the value of all taxable property within the City of Georgetown (businesses and homes). Changes in the property tax base, from either new properties being built or existing property valuations changing, can affect the tax impact each year either positively or negatively. The interest rate at the time the bonds are sold will also impact the tax rate, and lengthening the term of the bonds from 20 to 25 years also could lessen the maximum one-year tax impact. Georgetown’s current property tax rate is 41.8 cents per $100 valuation.

Why not just do these projects on a pay-as-you-go basis?

The City does as much as we can each year to maximize the annual capital improvement budget, but our infrastructure needs are greater than what annual funding can support. GO bonds offer the City a cost-effective financial tool to address a large number of both deferred maintenance and new infrastructure projects at over the course of several years.

Additionally, the City only issues GO bonds when a need has been identified. If the proceeds aren’t needed, like when a project doesn’t move forward, the City won’t issue the bonds. By borrowing the money upfront for large capital projects like road construction, the City is also able to lock-in construction prices upfront, which minimizes inflation in project costs. And lastly, funding large projects over a number of years through the repayment of debt increases taxpayer equity. New residents are moving to Georgetown every year. If the City were to pay for large projects each year with current taxes, then current taxpayers would be the only ones paying for growth. By matching a project’s funding to the number of years it will be in service, every generation of taxpayers who uses that asset can help pay for it.

Who would buy the GO bonds?

If the bond is approved, we will not know who will buy the GO bonds until they are sold in the market. Georgetown typically sells bonds competitively, but will choose a negotiated sale or private placement if it is in the best interest of the City of Georgetown.

For the 2015 bond, Fidelity Capital Markets, BOK Financial Securities, Inc., Citigroup Global Markets Inc., and UMB Bank, N.A., have each purchased a series of the 2015 bonds in separate competitive sales conducted by the City in recent years. Typically, the firm that purchases a series of bonds in a competitive sale will then sell some or all of those bonds to investors it has relationships with at or near the time of the competitive sale or later in the secondary bond market. The City typically chooses a competitive bond sale, because it ensures the lowest interest rate on the day of the bond sale, but it doesn’t allow the City to choose which underwriting firm will receive the bonds.

From whom do we borrow money for the bonds?

Typically, general obligation bond investors are large institutional investors, such as property and casualty insurance companies, mutual funds, and trust departments.

How long would the City be paying off the bond?

We have traditionally sold bonds with a 20-year payoff timeframe. Federal tax law does not allow the City to sell bonds that exceed the useful life of the project being financed, so if a road is expected to last 20 years, the bond cannot exceed 20 years.

Is there a stated expiration of the resulting tax increase if the bond is approved? It appears that once a tax is enacted, it stays forever.

There isn’t a stated expiration date; however, we cannot fund projects above what voters approve in the allocation. If we needed additional funding above that, we would have to go back out to voters. Once the $120 million principal and interest have been paid, the debt drops off of our requirements. We estimated a 3-cent increase to the property tax rate. If property values and collections are higher than we expect, the increase to taxes we would need to cover the approved allocations could be lower. The opposite is also true. We anticipate all the projects being started in seven years. It could be less; it could take longer. The City wants to address the highest mobility needs in the shortest amount of time with as small of an impact to property taxes as possible.

E-Newsletter Sign-Up:

Sign up for weekly updates about important City news.